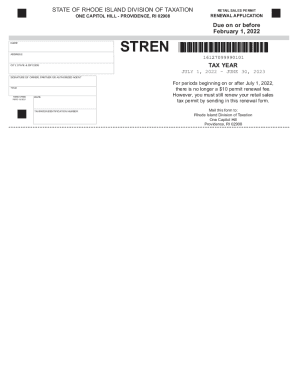

RI RI-STR-EFT 2016-2025 free printable template

Get, Create, Make and Sign RI RI-STR-EFT

How to edit RI RI-STR-EFT online

RI RI-STR-EFT Form Versions

How to fill out RI RI-STR-EFT

How to fill out RI RI-STR-EFT

Who needs RI RI-STR-EFT?

Video instructions and help with filling out and completing form ri str

Instructions and Help about RI RI-STR-EFT

Hello, IN×39’m BuBraddockck, Administrator for the Rhode Island Division of Motor Vehicles. You're about to watch one of a series of videos that will show you how the DMV works and how to prepare for your visit to the DMV. Of the more than 250 transactions that the DMV processes far from the most common are those pertaining to registration of vehicles and license transactions. The following video will show you what documents you need to register your vehicle here in Rhode Islands well as a step-by-step process of showing you how to fill out the forms necessary to register your vehicle. Thank you for taking the time to watch this video. Welcome to the DMV. Music Looking to register your vehicle with the state of Rhode Island? There are some things you should know before you make your way to the DMV. First, you will need to be sure you have all the necessary documents for the registration. Be sure to bring insurance information, proof of ownership, Rhode Island license or a proof of identity, a bill of sale or gift letter, proof of residency, a plate number, if available title is necessary for vehicles made during or after 2001. A previous registration is required for vehicles made in 2000 or before. And a completed TR-1 form. The TR-1 form is your registration form. Be sure to fill out all the required sections of your TR-1 form. You can find a document checklist for registration, as well as other transactions, online at the Division of Motor Vehicle×39’s websiteFirst, you will need to fill out your name. Then you will need to check off the transaction type. If you are not sure, you can leave this blank and a DMV clerk will do this. Section A of the TR-1 form is where you will fill out all the owner's information whether it be as an individual or as a business or a lease company. In Section B, you will provide the lessee×39’s information if the vehicle is being leased. Section C requires the seller's information. You can get this from the bill of sale or the gift letter. In Section D, you will prove the vehicle×39’s insurancinformationiRhodede Island insurance is required by law. Section E requires the vehicle's information. All fields are mandatory in this section of the TR-1 Form. Section F of the TR-1 form is only required if you are registering a commercial truck or vehicle. Section G covers the lender's information and is all to be completed if there is a vehicle loan. Finally, Section H of the TR-1 form requires your signature and the consent of the applicants×39

People Also Ask about

How much is a seller's permit in Rhode Island?

How much is a retail license in Rhode Island?

Do I need a sellers permit to sell online in Rhode Island?

How do I get a seller's permit in RI?

How do I get a retail sales permit in RI?

How do I renew my RI retail sales permit?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit RI RI-STR-EFT from Google Drive?

How do I edit RI RI-STR-EFT on an iOS device?

How can I fill out RI RI-STR-EFT on an iOS device?

What is RI RI-STR-EFT?

Who is required to file RI RI-STR-EFT?

How to fill out RI RI-STR-EFT?

What is the purpose of RI RI-STR-EFT?

What information must be reported on RI RI-STR-EFT?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.